Obamacare leaves poor in Mandate Limbo

Obamacare’s inflexible complexity along with its recently declared unconstitutional Medicaid expansion provision has left a certain segment of the population in Mandate Limbo.

Obamacare relies on two mechanisms to expand the number of people who have health coverage:

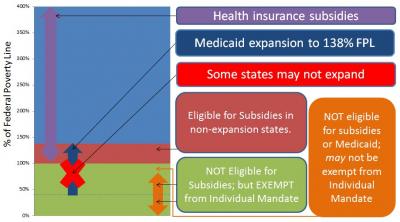

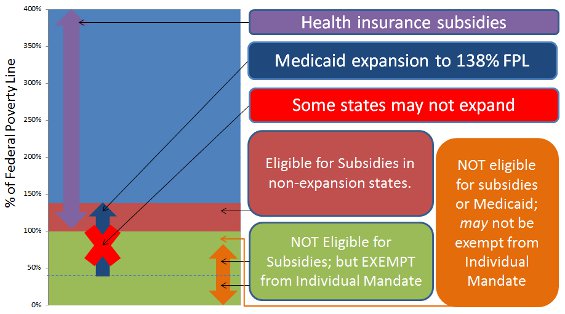

- Health Insurance Subsidies. It gives health insurance subsidies to individuals who make between 100% and 400% of the Federal Poverty Line.

- Medicaid. It requires that states expand their Medicaid programs so that everyone who makes up to 138% of the Federal Poverty Line is eligible.

Supreme Court exposes Obamacare’s unconstitutional reliance on coercion.

The problem is that the Obama Administration and the Democratic 111th Congress, assumed they could coerce the states to expand their Medicaid programs by threatening to revoke all federal Medicaid funding should states choose not to expand.

The Supreme Court called the Medicaid expansion requirement an unconstitutional, “gun to the head” coercion of the states. Even Justice Stephen Breyer (appointed by President Clinton) and Justice Elena Kagan (appointed by President Obama) agreed!

Now that states have an option, they are now investigating whether they can actually afford the expansion.[1]

Current Medicaid Levels

Current Medicaid eligibility levels are represented by a dotted line that divides the green area of Figure 1.[2]

Expanded Medicaid Levels

For states that choose to comply, Obamacare expands the Medicaid eligibillity threshold to 138% of the federal poverty line (represented by the blue arrow). Plus, it expands Medicaid to include everyone under 138%—not just children, the disabled, and the elderly.

Non-Expansion states

But a few states have already said they will not expand, and several others have said they are leaning against expansion.[3] What happens in these states?

- Windfall: Individuals between 100% and 138% percent of the poverty line, who would receive Medicaid in an expansion state, will now receive federal health insurance subsidies to help them purchase insurance through the health insurance exchanges.

- On Medicaid like before: For those who are already receiving Medicaid (everyone under the dotted line in Figure 1), there will be no change.

- Status quo–No Medicare but also no Mandate: The orange arrow[4] in Figure 1 represents those who are exempt from the Individual Mandate tax because, based on their income, the IRS doesn’t require them to file a tax return.

- Mandate Limbo: But there’s a group of individuals who are under the federal poverty line but make just enough to have to file a tax return. It is clear that these individuals will not be eligible for health insurance subsidies. Nor will they be eligible for Medicaid in most non-expansion states. What is not clear is whether they will be subject to the individual mandate.

Mandate Limbo

You will find yourself in Mandate Limbo if in 2014, you make the 2014 equivalent of between $9,750 and $11,170.[5]

There are primarily two potential exemptions for individuals who find themselves in Mandate Limbo:

Hardship waivers: First, Obamacare gives the Secretary of Health and Human Services the power to grant “hardship waivers.” So, like many other waivers within Obamacare, Americans must rely on the common-sense of bureaucrats to save them from Obamacare’s inherent miscalculations and excesses.

But HHS has yet to issue a regulation or other guidance on how it will determine if someone is suffering a hardship. So, we don’t know if those in Mandate Limbo will be eligible for this waiver.

Unaffordability exemption: There is another possible exemption. Obamacare grants an exemption to anyone whose share of their health insurance premium exceeds 8% of their income.

By one estimate, in 2014, a minimum level of individual insurance will cost at least $1,800 per year. If this is accurate people in Mandate Limbo will be exempt from the Individual Mandate as $1,800 will be above 8% of their incomes which (in 2012 dollars) is between $780 and $894.

But because we can only speculate how a minimum required plan will cost, the unaffordability exemption does not yet eliminate Mandate Limbo.

1. See Drew Gonshorowski, “Medicaid Expansion Will Become More Costly to States,” Heritage Foundation Issue Brief# 3709 (Aug. 30, 2012) available at http://www.heritage.org/research/reports/2012/08/medicaid-expansion-will-become-more-costly-to-states.

2. This line is merely conceptual and not to scale.

3. See The Advisory Board, “Where Each State Stands on ACA’s Medicaid Expansion,” THE DAILY BRIEFING (July 5, 2012) available at http://www.advisory.com/Daily-Briefing/2012/07/05/Where-each-state-stands-of-the-Medicaid-expansion.

4. This arrow is for conceptual purposes and is not drawn to scale.

5. For the 2012 tax year, the IRS filing threshold will be $9,750 and the federal poverty line is $11,170.

Source: Uploaded by user via RegWatch on Pinterest